Table of Contents

AMD’s AI chip event in June 2025 showcased its MI350 GPU series.

AMD’s AI Market Surge

Advanced Micro Devices (AMD) has reached a critical inflection point in 2025, with its stock soaring due to its growing dominance in the AI chip market. The AMD price target AI narrative gained traction after HSBC’s July 10, 2025, upgrade, setting a Street-high price target of $200. This bullish sentiment reflects AMD’s advancements in AI accelerators, despite global uncertainties like Middle East tensions impacting markets. As reported by Reuters on July 10, 2025, AMD’s AI-driven momentum is reshaping investor expectations.

AMD’s stock rose 4.2% on July 10, driven by optimism about its MI350 GPU series and partnerships like the one with OpenAI. This article explores the catalysts behind AMD’s surge, analyst forecasts, and the broader implications of geopolitical risks.

Analyst Upgrades and Price Targets

HSBC’s Bullish Outlook

HSBC analyst Frank Lee upgraded AMD from “Hold” to “Buy” on July 10, 2025, doubling the price target to $200, implying a 44.5% upside. As confirmed by Reuters, this target reflects AMD’s AI chip pricing power, with 2026 AI revenue forecasts 57% above consensus at $15.1 billion. HSBC also raised 2025 server shipment estimates by 5%, signaling robust demand.

Other analysts echoed this optimism. Mizuho raised its price target to $152 from $135 on July 3, 2025, citing strong AI accelerator demand, as reported by Investing.com. Melius Research set a $211 target, highlighting AMD’s leadership in GPU-driven AI infrastructure.

Market Sentiment and Challenges

Despite the bullish upgrades, analysts note challenges. Mizuho’s Vijay Rakesh pointed to software gaps limiting AMD’s competition with Nvidia, per TradingView’s July 4 report. TipRanks reported a Moderate Buy consensus with an average price target of $134.03, suggesting a slight downside from current levels. These mixed signals underscore the competitive AI chip landscape.

AMD’s AI Technology Breakthroughs

MI350 and MI400 Series

AMD’s MI350 GPU series, launched at its June 2025 AI event, has driven significant market enthusiasm. As noted by Al Jazeera on June 26, 2025, the MI350’s pricing strength and adoption of CoWoS packaging could boost earnings. The upcoming MI400 series, a full-rack AI server solution set for 2026, aims to rival Nvidia’s Vera Rubin platform, per Investing.com.

AMD’s partnership with OpenAI, reported by Trading News on July 1, 2025, enhances its AI positioning. The Helios platform, previewed for 2026, promises competitive scale and performance, boosting gross margins to 50% in Q1 2025, up 300 basis points year-over-year.

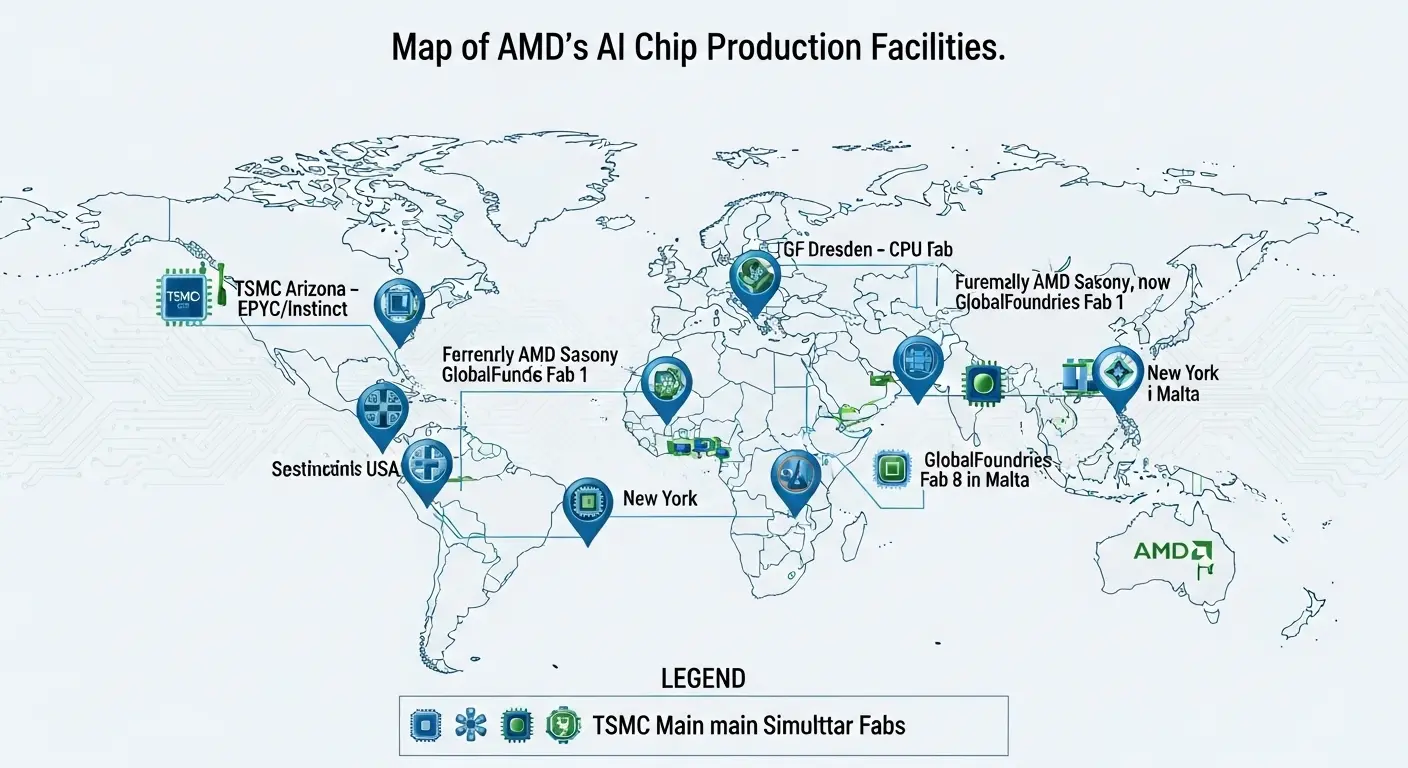

AMD’s global AI chip production facilities.

Strategic Acquisitions

AMD’s acquisition of ZT Systems’ engineering team, while selling its data center infrastructure, strengthens its AI capabilities. GlobeNewswire reported on June 10, 2025, that AMD’s EPYC CPUs will power Nokia’s cloud platform, reinforcing its data center dominance with a 57% revenue surge in Q1 2025.

Geopolitical and Market Impacts

Middle East Tensions and Oil Prices

Middle East tensions, including missile strikes and Gaza war impacts, have introduced market volatility. Reuters reported on July 7, 2025, that fears of regional escalation in the Persian Gulf could spike oil prices, affecting semiconductor supply chains. However, an Iran-Israel ceasefire in early 2025, noted by AInvest.com, has been a tailwind for AMD’s stock stability.

These geopolitical risks have not deterred AMD’s AI momentum. Axios reported on July 10, 2025, that the AI boom continues to drive market gains, with AMD benefiting from strong demand for AI chips despite trade-related risks like potential U.S. tariffs.

Economic Implications

AMD’s financial health supports its growth trajectory. With $7.3 billion in cash and $4.2 billion in debt in Q1 2025, AMD has the capital to scale production and repurchase shares, per Trading News. The company’s Q2 earnings, set for August 5, 2025, are expected to show 40% growth acceleration, as reported by MoneyCheck on June 27, 2025.

Future Outlook for AMD

AMD’s trajectory hinges on its ability to capitalize on AI demand and navigate geopolitical challenges. The MI355X AI accelerator, set for late 2025, is a key catalyst, with analysts projecting $32 billion in 2025 revenue, per Yahoo Finance. The Helios platform and MI400 series could further solidify AMD’s position against Nvidia.

However, nuclear threats and regional escalation risks in the Middle East could disrupt supply chains. Diplomatic mediation, such as UN efforts in the Golan Heights, may stabilize markets, but investors should monitor AMD’s Q2 earnings for insights into its AI strategy execution.

Conclusion

AMD’s stock surge, fueled by its AI chip advancements and analyst upgrades, marks a pivotal moment in its growth story. The AMD price target AI narrative underscores its potential to reshape the semiconductor industry, despite challenges like software gaps and Middle East tensions. With a robust financial position and strategic partnerships, AMD is well-positioned for 2025 and beyond. Investors should watch the August 5 earnings report and geopolitical developments in Damascus and the Persian Gulf for further clarity on AMD’s trajectory.

AMD’s Q2 2025 earnings press conference. Source: Getty Images

Frequently Asked Questions

What is driving AMD’s stock surge in 2025?

AMD’s stock is rising due to its AI chip advancements, particularly the MI350 series, and strong analyst upgrades, with HSBC setting a $200 price target.

How does AMD’s AI technology compare to Nvidia’s?

AMD’s MI350 and upcoming MI400 series are competitive, but software limitations hinder its ability to fully rival Nvidia, per Mizuho’s analysis.

Are Middle East tensions affecting AMD’s stock?

While missile strikes and oil price surges pose risks, an Iran-Israel ceasefire has supported AMD’s stability, as reported by AInvest.com.

What is AMD’s revenue outlook for 2025?

Analysts project $32 billion in revenue for 2025, driven by AI chip demand, with Q2 earnings expected to show 40% growth, per MoneyCheck.

When will AMD report its Q2 2025 earnings?

AMD will report its Q2 2025 financial results on August 5, 2025, as announced by GlobeNewswire.