Table of Contents

Entrepreneur balancing student loan forgiveness decisions with business planning

📊 Data & Key Findings

1. Strong negative correlation before forgiveness

A Federal Reserve Bank of Philadelphia working paper found a one standard deviation increase in student debt led to a 14% drop in businesses with one to four employees between 2000–2010 :contentReference[oaicite:0]{index=0}. With 70 fewer startups per county, the effect was significant.

2. Borrower behavior & income effects

According to Nav and Education Data Initiative, borrowers with $10,000 of student debt saw a 42% decline in business income, and owing over $30,000 cut startup likelihood by 11% :contentReference[oaicite:1]{index=1}. Gallup‑Purdue data show 26% of debt-free grads start businesses vs. only 16% with $40k+ in debt :contentReference[oaicite:2]{index=2}.

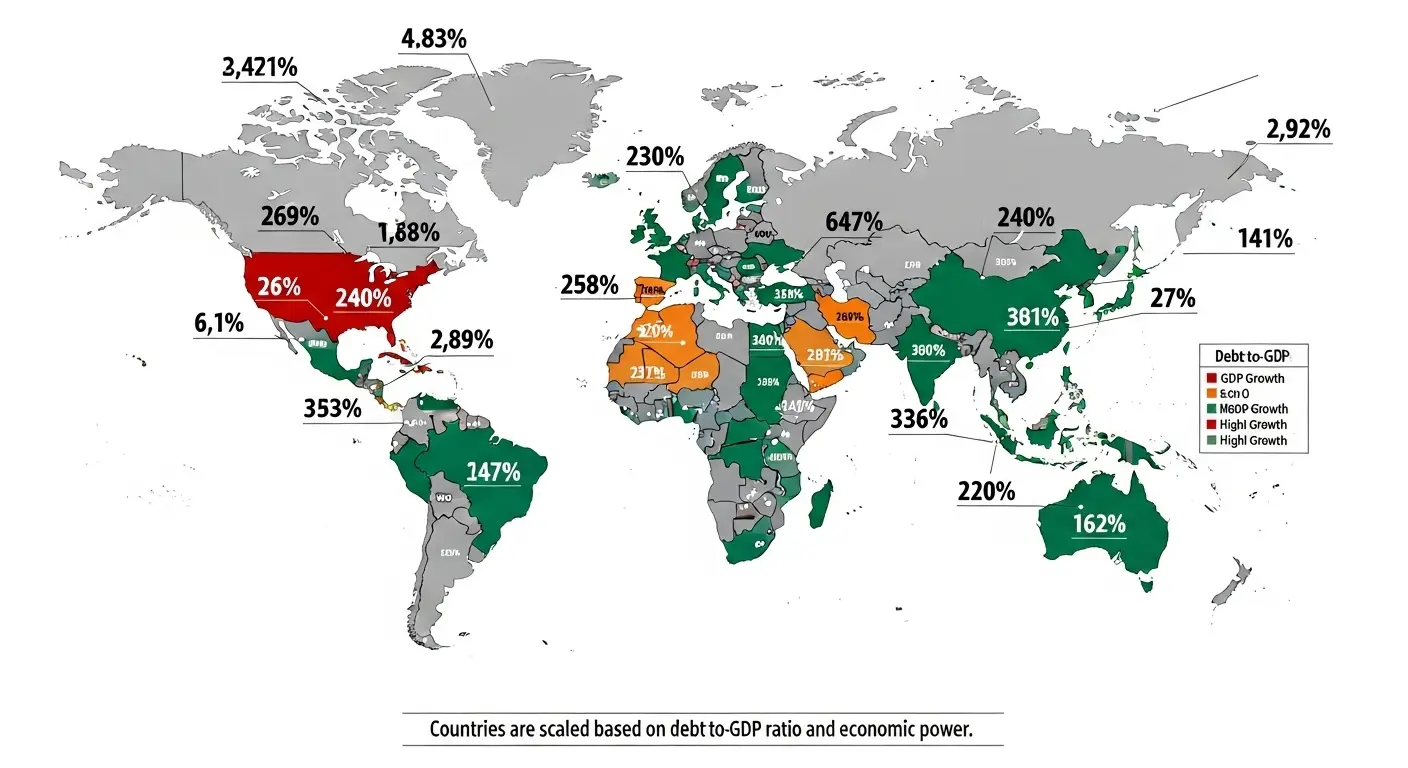

Infographic: County-level small business formation vs. debt burden

Case Studies & Forgiveness Projections

3. Forgiveness can unlock growth

Research by the Roosevelt Institute suggests canceling student debt could boost small business formation rates by up to 0.36 percentage points over a decade, with 50% of young entrepreneurs reporting student loans stalled their plans :contentReference[oaicite:3]{index=3}.

4. Household-level shifts

A 2025 MDPI study found student loan forgiveness improves household mobility, credit viability, and entrepreneurial intention :contentReference[oaicite:4]{index=4}. Erasing debt frees borrowers to invest in startups rather than servicing loans.

Economic Context & Broader Implications

Rising retail and housing economic stress due to student debt also stifles small business formation—forecast models show a 3.7% drop in consumer spending per 1% rise in debt-to-income :contentReference[oaicite:5]{index=5}. Increased airstrike retaliation fears, nuclear threats and regional escalation aside, domestic economic policy tools like loan forgiveness offer a tangible path to recovery.

Named entities in broader context include IAEA concerns about debt-enabled mobility, parallels to Gaza war impact on international funding, and economic stability linked to oil prices surge when domestic consumption weakens.

Conclusion & Future Outlook

The student loan forgiveness impact on small business formation is clear: by relieving debt burdens, it significantly boosts entrepreneurship, income, and economic momentum. While regional escalation and global tensions can shift priorities, policy reforms remain crucial. Looking ahead, we expect major initiatives—such as debt cancellation up to $10,000 per borrower—to deliver strong ROI and catalyze small business growth.

Frequently Asked Questions

Q1: How does student debt harm small business creation?

A: Debt limits access to capital and investors, slowing startups by up to 14% in small firms.

Q2: Will forgiveness actually lead to more businesses?

A: Yes—studies predict up to 0.36 ppt rise in startup rates and 50% of young entrepreneurs gaining impetus.

Q3: What debt amount matters most?

A: Even $10 k reduces income by 42%; over $30 k cuts startup chances by around 11 %.

Q4: Who benefits the most?

A: Small borrowers, millennial and Gen‑Z entrepreneurs, especially those relying on personal debt to bootstrap.

Q5: How can policy help?

A: Loan forgiveness, income-driven repayment reform, and credit improvement programs can unlock business formation.